Paycheck tax calculator georgia

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Georgia payroll calculators Latest insights The Peach State has a progressive income tax system with income tax rates similar to the national average.

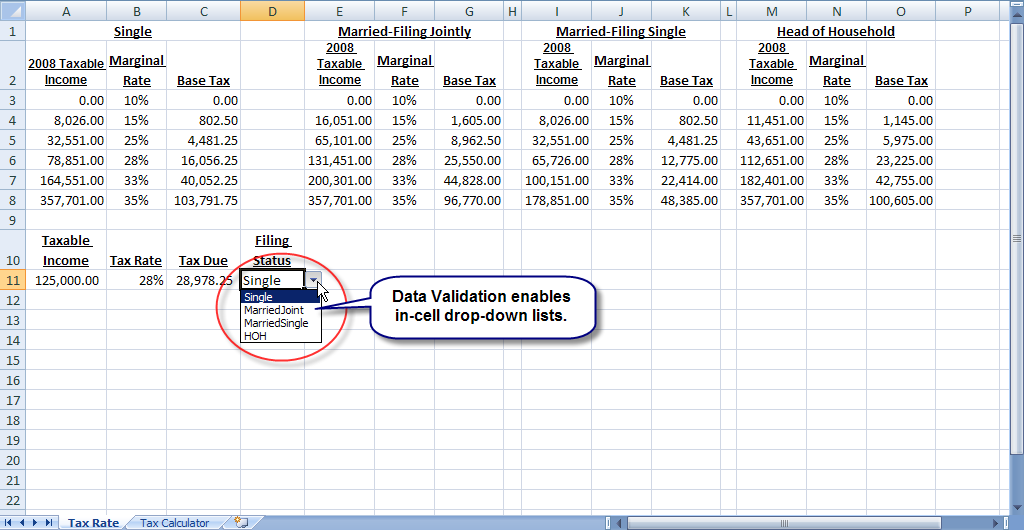

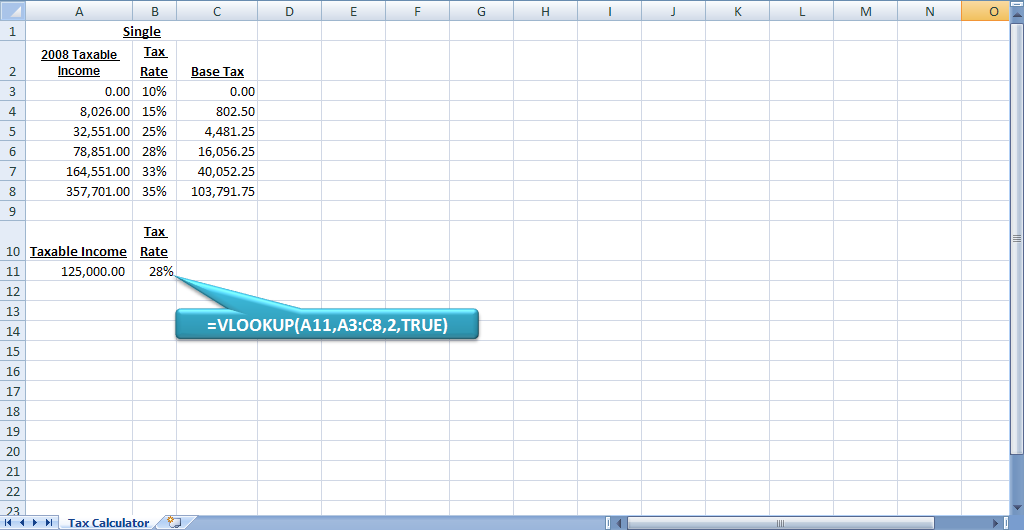

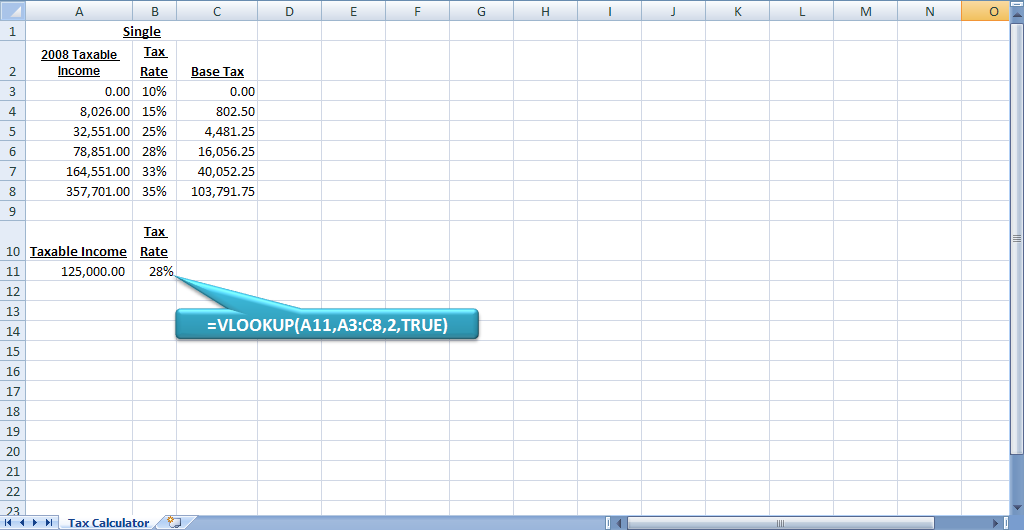

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

The Georgia Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

. This number is the gross pay per pay period. Paycheck Results is your gross pay and specific. Georgia Georgia Hourly Paycheck Calculator Results Below are your Georgia salary paycheck results.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. Georgia Salary Paycheck Calculator Results Below are your Georgia salary paycheck results.

Make Your Payroll Effortless and Focus on What really Matters. County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Tax Calculators Tools Tax Calculators Tools. The Weekly Wage Calculator is updated with the latest income tax rates in Georgia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Weekly. All you have to do.

Ad This is the newest place to search delivering top results from across the web. Calculate your federal Georgia income taxes Updated for 2022 tax year on Aug 31 2022. Payroll processing doesnt have to be taxing.

The results are broken up into three sections. Georgia Income Tax Calculator 2021. The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay frequencies.

If you make 100000 a year living in the region of Georgia USA you will be taxed 20339. The results are broken up into three sections. This Georgia bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Georgia Income Tax Calculator 2021. The Federal or IRS Taxes Are Listed. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

2022 tax rates for federal state and local. Pay electronically directly with DOR. Use the Georgia dual scenario hourly paycheck calculator to compare two hourly paycheck scenarios and see the difference in taxes and net pay.

The results are broken up into three sections. Ad Compare 5 Best Payroll Services Find the Best Rates. Get Your Quote Today with SurePayroll.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Your average tax rate is 1198 and your marginal tax rate is. Content updated daily for ga payroll calculator.

Subtract any deductions and. These calculators should not be relied. If you want to determine your.

If youre not yet registered. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993. Georgia Bonus Tax Aggregate Calculator Results Below are your Georgia salary paycheck results.

Get Started Today with 1 Month Free. Your average tax rate is 1501 and your marginal tax rate is. Paycheck Results is your gross pay and specific.

With just a few clicks the Gusto Georgia Hourly Paycheck Calculator shows you how payroll taxes are calculated. Use the Georgia Tax Center GTC the DORs secure electronic self-service portal to manage and pay your estimated tax. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Paycheck Results is your gross pay and. All Services Backed by Tax Guarantee. Use the Georgia paycheck calculators to.

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Income Tax Calculator Estimate Your Refund In Seconds For Free

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes Methods Examples More

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Payroll Taxes For Your Small Business

Georgia Paycheck Calculator Smartasset

Georgia Tax Calculator

Georgia Sales Reverse Sales Tax Calculator Dremploye

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Financial Advisors Tax